The United States faces an economic downturn without precedent. Is it also a moment that could produce lasting change?

The official unemployment rate was 13.3 percent in May, compared with 3.5 percent in February, and even the Labor Department thinks the recent figures are a substantial undercount. Covid-19 cases, which prompted the crisis, are surging in many states. And the burdens have landed disproportionately on people of color, just as crowds have protested the justice system’s treatment of African-Americans.

“You have three crises compounding each other: a 100-year pandemic, a 75-year depression and 50-year civil unrest,” said Rahm Emanuel, President Barack Obama’s first chief of staff and later Chicago’s mayor. This, he believes, opens political space for bold action.

The political system has already responded in ways unimaginable a few years ago. It took only a smidgen of negotiation in March for Congress to pass a $2 trillion stimulus program by an overwhelming majority, including a temporary supplement to unemployment insurance payments and direct payments to low- and middle-income families.

To some in the economic and political arenas, that should be only a start.

Scholars are brimming with ideas to construct a more generous safety net on a permanent basis, bolstering everything from Medicaid to child care support. Timothy Smeeding, a professor of economics and public affairs at the University of Wisconsin, Madison, suggests that the federal government pick up the entire tab for Medicaid, which it now shares with the states.

This would save struggling states nearly $250 billion a year and allow the federal government to establish a uniform set of benefits covering things like mental health and reproductive health, which some states have balked at. With an additional $44 billion, Mr. Smeeding added, the government could extend the $2,000 child tax credit to families with no income, subsidize child care and expand the earned-income tax credit.

Mr. Emanuel is thinking in similar terms. He and his brother Ezekiel, a medical ethicist who also worked in the Obama administration, have put together a plan in which the federal government would take over states’ responsibility for Medicaid and unemployment insurance, in exchange for state commitments to fund universal prekindergarten, expand spending on public colleges and invest in infrastructure.

“This offers both parties policy accomplishments and political benefits,” Rahm Emanuel said. “There is a grand bargain that has more winners than losers. That is in the tradition of American politics and policymaking.”

This would not be the first time an economic crisis opened the door for an expansion of government assistance. Indeed, much of the American social safety net was built during the Franklin D. Roosevelt administration in response to the Great Depression.

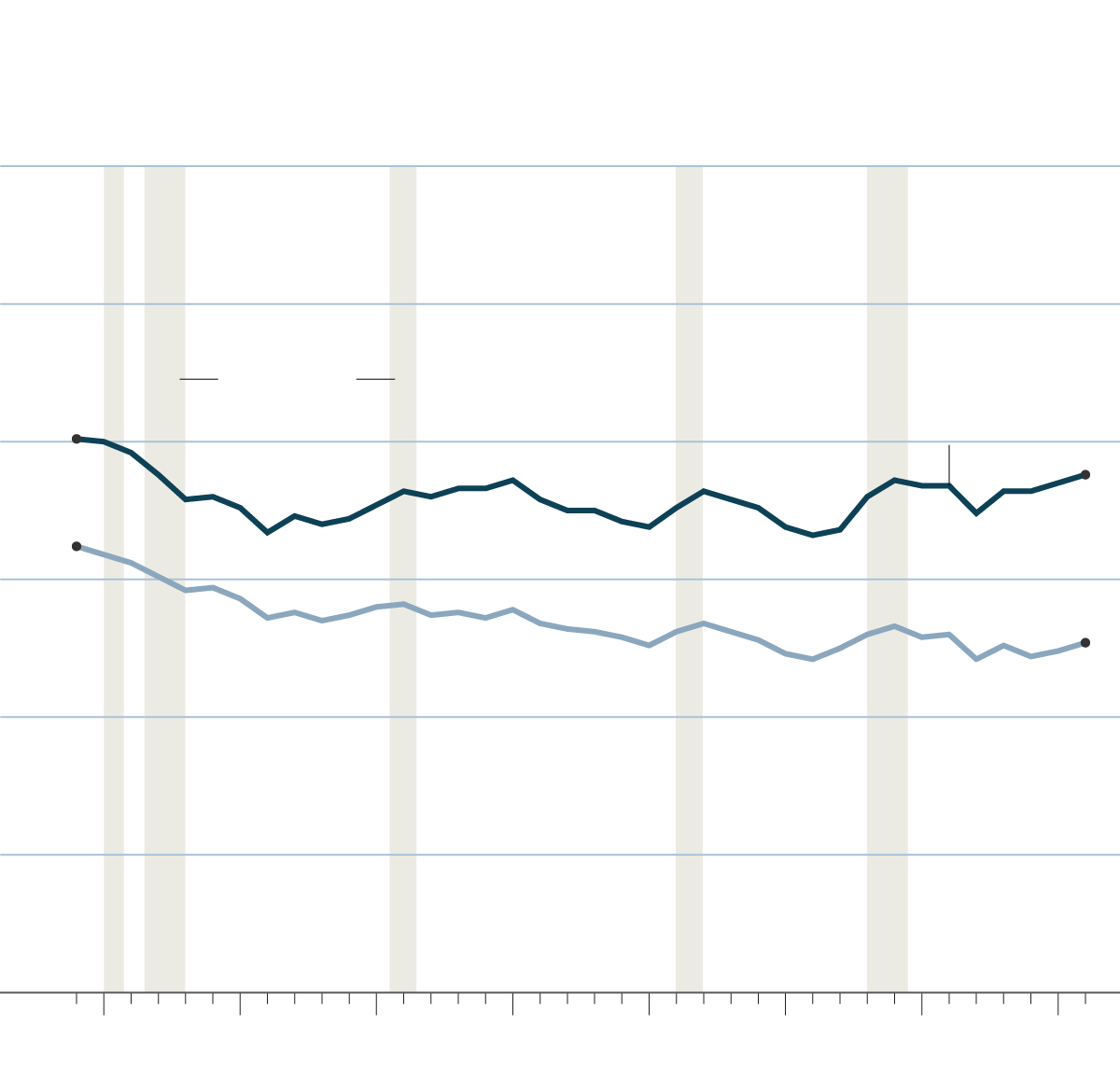

Share of income of the bottom 40 percent,

before and after taxes and transfers

30

%

25

Share of bottom 40%

RECESSIONS

After taxes and transfers

20

15

Before taxes and transfers

10

5

0

’80

’85

’90

’95

’00

’05

’10

’15

Share of income of the bottom 40 percent,

before and after taxes and transfers

30

%

25

Share of bottom 40%

RECESSIONS

After taxes and transfers

20

15

Before taxes and transfers

10

5

0

’80

’85

’90

’95

’00

’05

’10

’15

More recently, the Great Recession offered an opportunity for the Obama administration to build on it. In 2009, government redistribution efforts, including food stamps, tax provisions and other social programs, shifted 5.3 percent of the nation’s income that year to the poorest 40 percent of households. This was the biggest such transfer in at least three decades, raising the incomes of that contingent to 18.6 percent of the total.

By the end of his presidency, Mr. Obama had not only extended health insurance to millions of working-class Americans. According to the Congressional Budget Office, in 2016 government programs transferred 6.1 percent of national income to the poorest 40 percent, increasing their slice to 18.8 percent, the largest in almost a quarter-century.

Mr. Obama’s chief economic adviser, Jason Furman, highlighted the “historic achievement” of the administration in mitigating the nation’s income inequality.

Mr. Emanuel, who in the depths of the crisis argued that “you never want a serious crisis to go to waste,” acknowledged that the administration might not have achieved all its policy goals, but said, “It wasn’t a swing in the wind.”

In the coronavirus crisis, however, not everybody shares this sense of political opportunity.

Walter Scheidel, an economic historian at Stanford University, has written exhaustively about the power of crises — wars, famines, natural disasters, pestilence — to shift societies onto a more egalitarian path. As far back as the Roman Empire and even beyond, he writes, the equalizing moments in history “shared one common root: massive and violent disruptions of the established order.”

While the current emergency might seem like a big deal, Mr. Scheidel argues, it probably won’t be damaging enough. “If the crisis is bad enough, it might shape preferences enough to shift where the majorities are,” he said. “But it’s not something I see happening any time soon. We are too stable.”

And that reveals one important effect of the country’s social safety net: Though too weak to mitigate deepening inequality, it is generous enough to prevent Americans from pushing for more radical policies.

Growth in average income since 1979 by income group,

after transfers and taxes

+

300

%

Top 1 percent

+

250

RECESSIONS

+

200

+

150

Lowest quintile

+

100

81st to 99th

percentiles

+

50

Middle three quintiles

(21st to 80th percentiles)

0

’80

’85

’90

’95

’00

’05

’10

’15

Growth in average income since 1979

by income group, after transfers and taxes

+

300

%

Top 1 percent

+

250

RECESSIONS

+

200

+

150

Lowest quintile

+

100

81st to 99th

percentiles

+

50

Middle three quintiles

(21st to 80th percentiles)

0

’80

’85

’90

’95

’00

’05

’10

’15

As Gary Burtless of the Brookings Institution points out, inequality declined by some measures during the nation’s recent recessions. The share of income going to the poorest fifth of the population increased slightly in 1990, 2001, 2008 and 2009, even as incomes at the top fell sharply. Expanded unemployment insurance and other programs shielded the poorest Americans from the full brunt of the downturns.

The flip side is that inequality surges during economic expansions. And the tax and transfer system has been powerless to offset it. For instance, despite the Obama administration’s push against inequality, during the expansion from 2009 to 2016 the share of the nation’s income accruing to the richest 10 percent of the population jumped to 33.5 percent from 32.1 percent after considering taxes and transfers, according to a Congressional Budget Office analysis. This vastly outpaced the growth in the share accruing to the poorest 40 percent.

Government in the United States spends less on social programs to benefit the less fortunate than most other advanced nations, even though — by international standards — the poverty rate is the highest among the 35 countries in the Organization for Economic Cooperation and Development.

And in important respects, the American safety net has been getting weaker.

Despite the large increase in spending on unemployment insurance and food stamps, the safety net was less effective in the Great Recession than during the recession of the early 1980s in protecting those at half the poverty line or less, according to an analysis by Hilary Hoynes of the University of California, Berkeley, and Marianne Bitler of the University of California, Irvine.

The main reason, Ms. Hoynes noted, was the increase in the conditionality of government benefits. Unconditional cash assistance for poor families was largely replaced after the 1996 welfare law with programs that usually require people to work, such as the earned-income tax credit and the Temporary Assistance for Needy Families program. The tax credit “is great for a number of things,” Ms. Hoynes said, but losing your job means losing the credit.

Since the Great Recession, work requirements have been attached to more bits of the safety net, including food stamps and Medicaid. And for all the support for #BlackLivesMatter evident on the streets, racial animus remains a strong political constraint in developing more generous assistance programs.

Research has found that after the welfare overhaul of 1996 empowered states to set rules for benefit entitlement, those with larger African-American populations provided less cash assistance to poor families. Moreover, welfare officers are more likely to punish African-American families for violations of program rules.

Martin Gilens of Yale has written extensively about the power of racism to stunt the American safety net, concluding that “racial attitudes are in fact the most important source of opposition to welfare among whites.”

Racial divisions show no sign of dissipating. “I have reviewed nearly every academic article containing the name ‘Donald Trump,’” wrote Matt Grossmann, a political scientist at Michigan State University. “This huge literature has plenty of disagreements — but the dominant findings are clear: Attitudes about race, gender and cultural change played outsized roles in the 2016 Republican primaries and general election.”

While the images of young protesters in the streets of American cities after the killing of George Floyd in Minneapolis last month might suggest political support for expanding the safety net to lift the most vulnerable, research suggests that such protests can motivate a backlash.

As Mr. Emanuel noted, one consequence of Mr. Obama’s efforts to expand government assistance after the Great Recession was a movement against government spending more widely: the Tea Party.