It seems the global pandemic has folks paying more to drink at home.

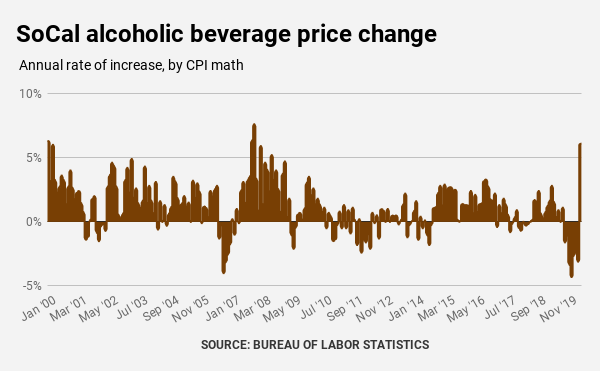

The coronavirus has boosted local prices of beer and booze, according to the Consumer Price Index for Los Angeles and Orange counties. The cost of store-bought alcoholic beverages was 6.1% costlier in April than a year ago, the biggest jump in more than 12 years. This comes as overall inflation in the region hits a five-year low.

Alcohol pricing is just another example of just how quickly economics have changed. The CPI measurement for local alcoholic beverages sold at stores showed prices falling for seven consecutive months before April. Previously, competition for drinkers was apparently stiffer.

“Stay safe at home” rules took full effect in April. These edicts cut jobs in the region while forcing other workers to do business at home. As a result, many merchants’ ability to sell was throttled, most notably at bars and restaurants.

The resulting lack of cash for some consumers forced many retailers to lower prices. So overall inflation in Los Angeles and Orange counties rose at a mere 0.7% annual rate in April.

STAFF GRAPHIC

The business of beer and booze changed, too. Going out for drinks became shelter-in-place cocktails. As a result, the CPI says folks paid up for store-bought alcohol.

History tells us this kind of price volatility isn’t just one of those “unchartered waters” events only seen in pandemic-twisted marketplaces. Let’s note the previous eras in which alcohol prices jumped like this.

Last was November 2007 when real estate’s bubble was bursting, a painful collapse that rolled into the Great Recession. Then ponder the previous peak in local alcohol inflation: Early 2000, another time of economic uncertainty as technology’s dot-com stocks were crashing.

One could conclude looking at the timing of these price spikes during business downturns that alcohol is being used to calm nerves during stressful periods. On the other hand, pouring one’s favorite adult beverage at home is cheaper than going out for drinks — even if the store has raised its prices.

So maybe these price movements reflect folks pinching pennies in tough times?

Look at how other merchants have reacted in the virus-era, based on what’s found in the local CPI report for April:

• Apparel prices fell 6.4% in a year. Those stay-at-home orders lowered the need to dress for work. And if you’re out of work, you can wear old clothing.

• The cost of big-ticket “durable goods” (vehicles, appliances and furniture) was 2.1% lower in a year. Used car prices, by this math, fell 1%. Jobless folks can live with an old fridge or couch and drive the clunker a few more months.

• And gasoline is far cheaper, costing 28.3% less in the last 12 months. Well, since driving is way down, few folks are benefiting from discounted fuel. This drop is tied to slashed prices of the key ingredient, crude oil.

Please note that not all local consumer costs were falling.

Higher prices were found for all services, up 2.4% pricier, household energy cost 4.3% more, groceries rose 2.4%, eating out got 4.8% more expensive, and medical bills were 3.6% costlier.

And there’s the long-running SoCal pocketbook challenge: The cost of putting a roof over one’s head. This expense, which eats up the biggest share of local household budgets, rose at a 3.2% annual pace in the past year.

You know, minus these local shelter costs, the region’s CPI would have been falling at a 1.1% rate. Yes, by CPI math, everything but housing is cheaper.

Except the booze.