Another 90,000 Airline Jobs Set To Disappear By Year-End As

National Lockdown Looms Tyler Durden

Thu, 11/12/2020 – 15:11

Despite the bullish news surrounding�Pfizer’s

COVID-19 vaccine earlier this week, lifting airline stocks to

the stratosphere, on hopes of a recovery in the severely beaten

down travel and tourism sector, an industry group warned Thursday

about the dire situation still facing many airlines.

U.S. Global Jets ETF Jumped On Pfizer COVID-19 Vaccine

News

Airline For America’s CEO Nick Calio, speaking at a conference

Thursday morning, said air travel demand is “softening” late in the

year. He said some of the reasons for the slump could be due to the

resurgence of

the virus pandemic.

*US AIRLINE DEMAND IS

SOFTENING, AIRLINE LOBBY GROUP CEO SAYS— zerohedge (@zerohedge)

November 12, 2020

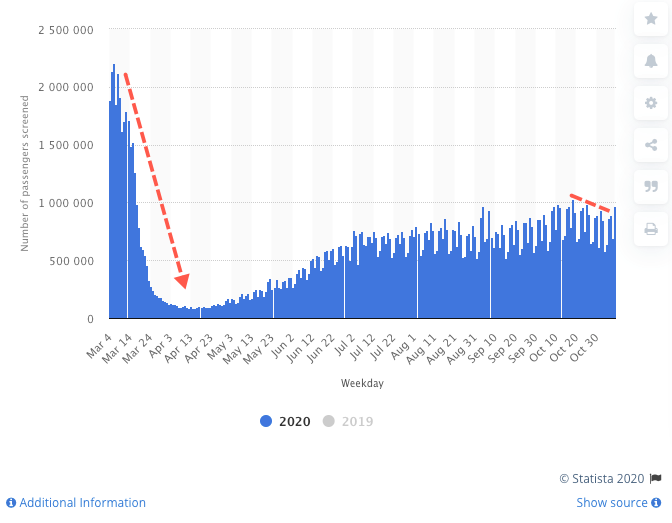

The daily number of passengers screened at TSA checkpoints in

the U.S. from March 2019 to November 2020 remains halved from early

March levels. As the second wave of the virus pandemic ravages many

parts of the U.S. – what appears to be happening in the chart below

are lower volumes of daily passengers screened at TSA checkpoints

that peaked

on Oct. 18.

Calio said airlines’ Thanksgiving-week capacity could be down as

much as 39% from a year ago, compared with a 47% drop in the first

half of November. It was also noted that corporate air travel in

the US remains 86% below 2019 levels.

He said airlines could ax upwards of 90,000 workers this year as

many carriers must reduce costs to survive the downturn. A muted

recovery so far and waning revenues have left airlines in a

precarious position – where they’re quickly running out of cash. At

the moment, airlines are burning through $180 million per day, with

only enough cash through 1Q21.

*US AIRLINES EXPECT DAILY CASH

BURN TO CONTINUE THROUGH 1Q 2021*US AIRLINES: SITUATION STILL DIRE, DAILY CASH BURN AT $180 ML

— zerohedge (@zerohedge)

November 12, 2020

In October, the International Air Transport Association (IATA)

warned that global airlines are

on track to lose nearly $130 billion this year – significantly more

than June’s estimates of $84 billion.

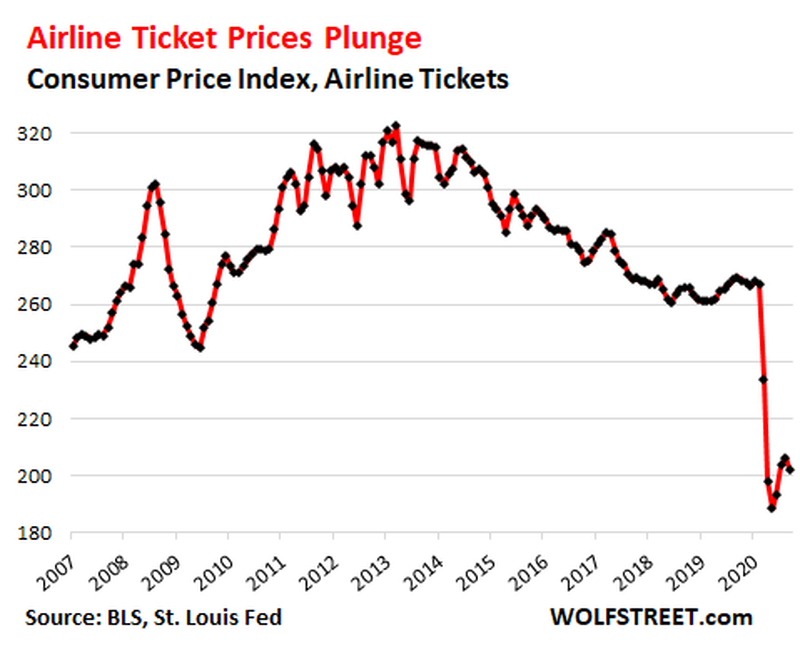

IATA has already said the virus-induced downturn has resulted in

30 or 40 airlines having failed or restructured in bankruptcy.

IATA analysis shows airlines have about three-quarters of cash

on hand at the current burn rate. With airline passenger volumes

still down 65% in October from last year, airline ticket prices

have crashed,

increasing worries that airlines’ revenue streams won’t be enough

to service existing debts.

To survive, some airlines, such as Emirates,

the largest commercial airline in the UAE, have converted some of

its passenger jets into “mini-freighters” to haul medical supplies

worldwide.