Visualizing How US Consumers Are Spending Differently During

COVID-19 Tyler Durden

Tue, 05/26/2020 – 23:45

In 2019, nearly 70% of U.S. GDP was driven by personal

consumption. However,

as Visual Capitalist’s Iman Ghosh notes, in the first

and second quarters of 2020, the COVID-19 pandemic has initiated a

transformation of consumer spending trends as we know

them.

Consumer Spending in Charts

By leveraging new data from analytics platform1010Data, today’s

infographic dives into the credit and debit card spending of five

million U.S. consumers over the past few months.

Let’s see how their spending habits have evolved over that

short timeframe:

The above data on consumer spending, which comes from 1010Data

and powered by AI platform Exabel, is broken into 18 different

categories:

-

General Merchandise & Grocery: Big Box,

Pharmacy, Wholesale Club, Grocery -

Retail: Apparel, Office Supplies, Pet

Supplies -

Restaurant: Casual dining, Fast casual, Fast

food, Fine dining -

Food Delivery: Food delivery, Grocery Delivery,

Meal/Snack kit -

Travel: Airline, Car rental, Cruise, Hotel

It’s no surprise that COVID-19 has consumers cutting back on

most of their purchases, but that doesn’t mean that specific

categories don’t benefit from changes in consumer habits.

Consumer Spending Changes By Category

The onset of changing consumer behavior can be observed from

February 25, 2020, when compared year-over-year (YoY).

As of May 12, 2020, combined spending in all categories dropped

by almost 30% YoY. Here’s how that shakes out

across the different categories, across two months.

General Merchandise & Grocery

This segment saw a sharp spike in initial spending, as Americans

scrambled to stockpile on non-perishable food, hand sanitizer, and

toilet paper from Big Box stores like Walmart, or Wholesale Clubs

like Costco.

In particular, spending on groceries reached a YoY increase

of 97.1% on March 18, 2020. However, these sudden

panic-buying urges leveled out by the start of April.

Pharmaceutical purchases dropped the most in this segment,

possibly as individuals cut back on their healthcare expenditures

during this time. In fact, in an April 2020 McKinsey survey

of physicians, 80% reported a decline in patient

volumes.

Retail

With less foot traffic in malls and entire stores forced to

close, sales of apparel plummeted both in physical locations and

over e-commerce platforms.

Interestingly, sales of office supplies rose as many pivoted to

working from home. Many parents also likely required more of these

resources to home-school their children.

Restaurant

The food and beverage industry has been hard-hit by COVID-19.

While many businesses turned to delivery services to stay afloat,

those in fine dining were less able to rely on such a shift, and

spiraled by 88.2% by May 5, 2020,

year-over-year.

Applebees or Olive Garden exemplify casual dining, while Panera

or Chipotle characterize fast casual.

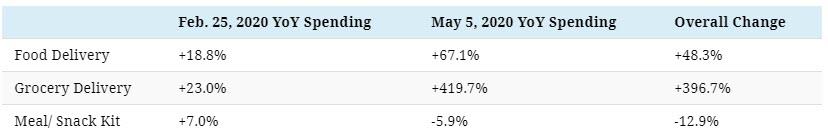

Food Delivery

Meanwhile, many consumers also shifted from eating out to home

cooking. As a result, grocery delivery services jumped by over

five-fold—with consumers spending a

whopping 558.4% more at its April 19, 2020 peak

compared to last year.

Food delivery services are also in high demand, with Doordash seeing

the highest growth in U.S. users than any other food delivery app

in April.

Travel

While all travel categories experienced an immense

decline, cruises suffered

the worst blow by far, down by 87.0% in YoY

spending since near the start of the pandemic.

Airlines have also come to a halt, nosediving

by 91.4% in a 10-week span. In fact, governments

worldwide have pooled together nearly $85

billion in an attempt to bail the industry out.

Hope on the Horizon?

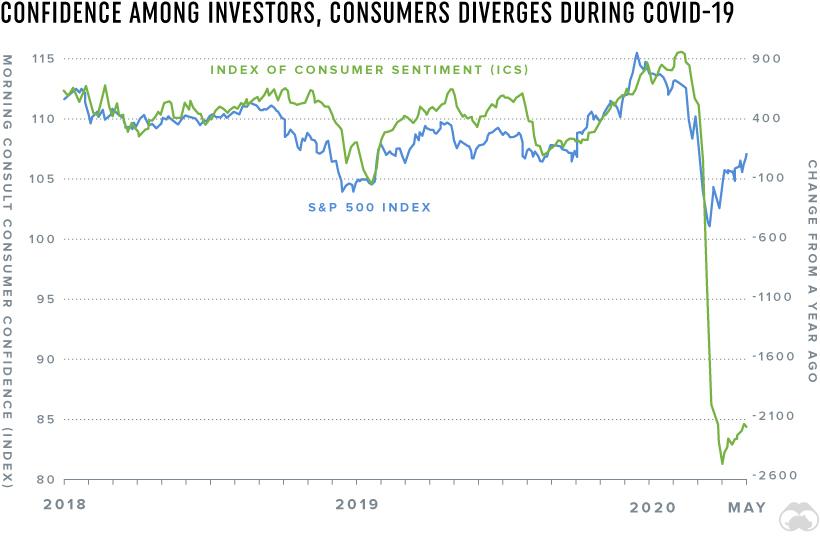

Consumer spending offers a pulse of the economy’s health.

These sharp drops in consumer spending fall in line with the steep

decline in consumer confidence.

In fact, consumer confidence has eroded even more intensely than

the stock market’s performance this quarter, as observed when the

Index of Consumer Sentiment (ICS) is

compared to the S&P 500 Index.

Many investors dumped their stocks as the coronavirus hit, but

consumers tightened their purse strings even more. Yet, as the

chart also shows, both the stock market and consumer sentiment are

slowly but surely on the mend since April.

As the stay-at-home curtain cautiously begins to lift in

the U.S., there may yet be hope for economic recovery on the

horizon.