76% of US CEOs Will Slash Office Space As Remote Work Dominates�

Tyler

Durden Sun, 10/25/2020 – 13:00

The virus pandemic has accelerated more flexible work options

for employees, with many companies instructing employees to work

remotely through 2021, or in some cases, permanently.

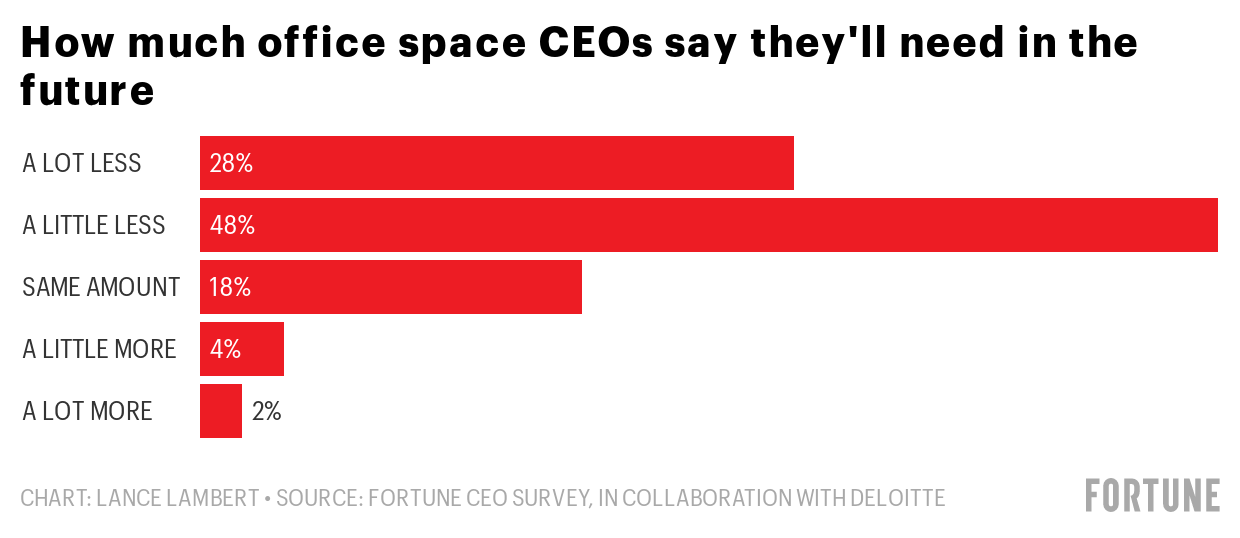

As a result, according to a new survey, CEOs have said they will

slash office space, a move that could ripple through commercial

real estate markets, all the way down into local economies.

In collaboration with Deloitte,

Fortune surveyed 171 CEOs between Sept. 23 to 30, found 76% of

respondents are expected to reduce office space size in the near

term. About 28% of them said they would need “a lot less” corporate

space.

The survey is an eye-opener for all the empty office buildings

in major metro areas as remote work continues to dominate. The

prolonged economic downturn and

persistent virus pandemic are whipping up a perfect storm where

companies must reduce their corporate footprint.

Remote working, continued virus pandemic, social unrest, and a

surge in violent crime have contributed to a mass exodus of city

dwellers who have escaped to suburbia. Among CEOs surveyed, 40%

said remote working has increased productivity. Inversely, 31% of

CEOs said remote working decreased productivity.

Corporate America scaling back on office space will continue to

pressure certain CMBS

tranches that are heavily weighted with office buildings,

suggesting as remote working continues, for at least the next 6 to

12 months, building operators could experience slumping rental

income, resulting in missed mortgage payments and could

send deliquesces soaring.

CMBS Deliquesces Remain Elevated

The scale-back of corporate space because of remote working will

also damage local economies that surround business districts. This

will be a mass hit to gas stations, restaurants, and other shops,

who depend on commuters, will see less and less traffic for the

next few years. In July, we noted remote working would

remove some 14 million cars from American highways.

The bad news here is that a commercial real estate crisis

looms.