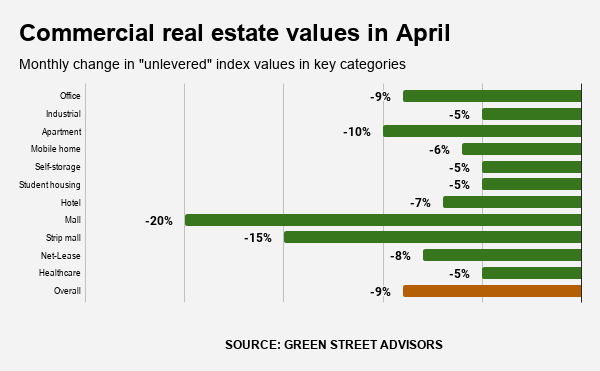

Commercial real estate values nationwide fell 9% in April as pandemic containment throttled the economy.

Green Street Advisors in Newport Beach tracks commercial real estate values in two ways. Analysts watch both publicly owned real estate investment trusts traded on Wall Street and property dealings among privately held funds. Once a month Green Street combines that research into indexes tracking real estate performance in key categories.

The coronavirus outbreak halted what had been commercial real estate’s long rebound from the depths of the Great Recession, where values plummeted by one-third. Business limitations due to various stay-at-home mandates have hurt property owners’ ability to collect rents as tenants lost jobs or cash flow. The industry also found that renting empty spaces — whether it be overnight (think, hotels) or a longer term — was very challenging.

Green Street’s overall commercial real estate index, measuring “unlevered” valuations, for April was down 9% in a month and down an overall 8% in the past 12 months. In April, all 11 subindexes fell for the month and only two had gains in the past year. April’s bigger loser was malls; smallest losses were seen in industrial, self-storage and healthcare properties.

Here’s how Green Street broke down values by commercial real estate niches. Start with the basics …

Office: down 9% in a month and lost 6% in the year.

Industrial: down 5% in a month but gained 7% in the year.

Then there are the businesses putting roofs over people’s heads or goods …

Apartments: down 10% in a month and lost 3% in the year.

Self-storage: down 5% in a month and lost 2% in the year.

Hotels: down 7% in a month and lost 16% in the year.

Student housing: down 9% in a month and lost 8% in the year.

Mobile home parks: down 6% in a month but gained 11% in the year.

Next are the retail categories …

Malls: down 20% in a month and lost 33% in the year.

Strip malls: down 15% in a month and lost 13% in the year.

And some specialty groupings …

Healthcare: down 5% in a month and lost 5% in the year.

Net-lease properties: down 8% in a month and lost 9% in the year.